Articles Description

Fundraising is a critical milestone for startups aiming to scale their operations, build innovative solutions, and capture market opportunities. While securing funds can be daunting, understanding the landscape and following a structured process for identifying and engaging with investors can make all the difference. Here, we explore key strategies and insights to help startups succeed in their fundraising journey.

Understanding the Startup Funding Landscape

The journey of securing funding begins with identifying the stage of your startup and aligning it with the right investor type. The typical funding stages include:

-

Bootstrap: Early-stage funding from personal savings or revenue reinvestment.

-

Friends & Family: Financial support from close connections.

-

Angels & Seed: Contributions from angel investors or seed-stage funds.

-

Series A to Growth: Larger rounds involving venture capital (VC) firms, private equity, and corporate investors.

Each stage corresponds to different funding sources such as angel investors, government agencies, accelerators, and VC funds. Knowing where your business fits in the ecosystem is essential.

What Investors Look For

Investors use specific frameworks to evaluate startups. These include:

-

People: A strong, experienced team with the ability to execute.

-

Product: Innovative solutions addressing real problems.

-

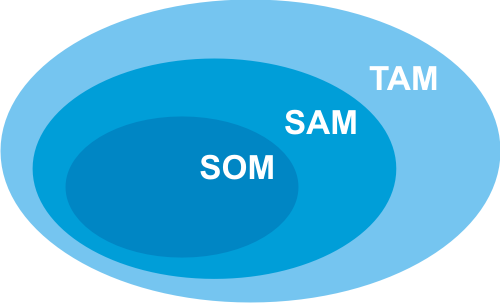

Market Opportunity: A large, growing market with potential for scalability.

Startups must demonstrate:

-

Traction: Metrics proving market demand.

-

Differentiation: Unique selling points or competitive advantages.

-

Vision: A clear roadmap for growth and profitability.

Identifying and Engaging the Right Investors

A systematic approach to finding and engaging investors can improve your chances of success:

-

Research and Categorize:

-

Identify investors who specialize in your industry and startup stage.

-

Use tools like Crunchbase, LinkedIn, and investor directories to create a list of potential investors.

-

-

Leverage Your Network:

-

Seek introductions through mutual connections.

-

Attend industry events, pitch days, and networking sessions.

-

-

Customize Your Outreach:

-

Tailor your communication to each investor, highlighting why your startup aligns with their portfolio.

-

Prepare a concise and compelling summary of your business.

-

-

Build Relationships:

-

Engage with investors through informal meetings or events before formally pitching.

-

Share regular updates about your progress to keep them interested.

-

-

Apply to Funding Programs:

-

Explore accelerators, incubators, and government grants that provide funding and mentorship.

-

Ensure your application stands out by clearly articulating your startup’s value proposition and impact.

-

-

Follow-Up and Persistence:

-

Don’t hesitate to follow up after initial outreach.

-

Keep track of your interactions and maintain professionalism throughout.

-

Key Tips for Fundraising Success

-

Know Your Audience: Research potential investors to understand their preferences and priorities.

-

Networking: Attend events, seek referrals, and build relationships within the ecosystem.

-

Be Prepared: Anticipate questions and have a well-documented business plan.

-

Empathy: View your approach through the investor’s lens—what’s in it for them?

-

Maintain Focus: Highlight the problem-solution fit and growth potential succinctly.

Overcoming Challenges

Securing funding is rarely smooth sailing. Many startups face rejection, but persistence and adaptability are key. Understand that most VC investments fail, so investors look for teams that can pivot and persevere through challenges.

Conclusion

Fundraising is both an art and a science. By understanding the funding landscape, aligning with the right investors, and following a structured process to engage them effectively, startups can significantly enhance their chances of success. Remember, it’s not just about raising capital; it’s about finding partners who believe in your vision and can help bring it to life.

Madarek Article

Madarek Article